Steps to Download TATA Motors Finance online statement. TATA motors finance loan statement download. Download Tata Motors Finance Statement. Download Tata Motors Finance online Statement 2025 at https://tmf.co.in

Tata Motors Finance Loan Statement Download

The Tata Motors Finance Limited holds global recognition and offers great car deals loans for passenger and commercial vehicles. The company helps eligible users purchase vehicles at affordable rates and pay in installments. Applicants can avail flexible loans with a payment period of 12 to 60, or 84 months based on a loan agreement with Tata Motors Finance Limited.

The company is a subsidiary Company Tata Motors Ltd, and was established in 1957. Indian residents can apply for different motor vehicle loans to satisfy personal and business needs. The application process is very simple and requires proof of a legal agreement.

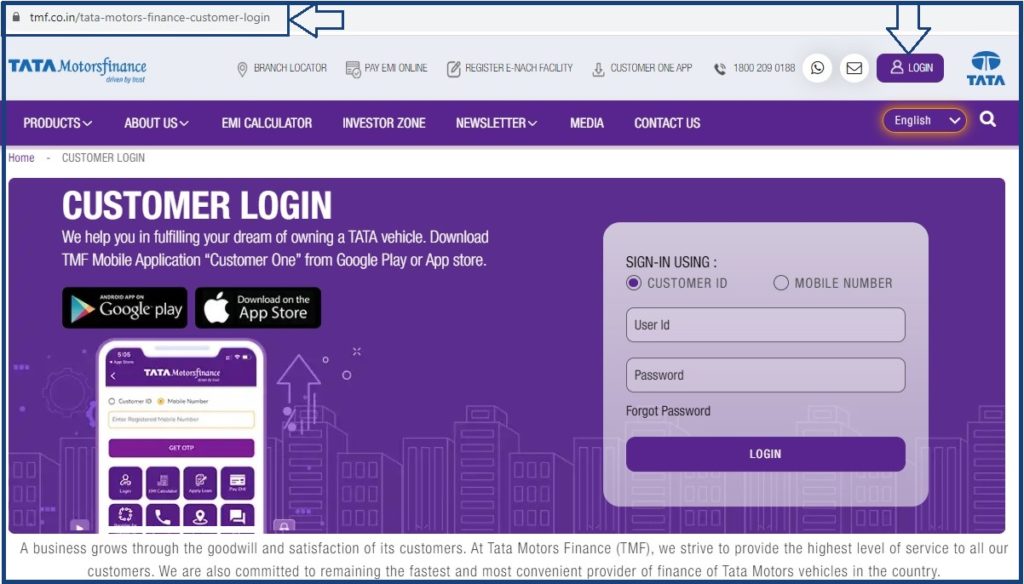

Tmf.co.in

tmf customer login

Eligibility Criteria for Tata Motors Finance Limited Car Loans

To get the Tata personal or commercial vehicle, the applicant must fulfill the following details:

- Applicant should be 21 years to 65 years.

- One should be salaried or self-employed.

- Applicants can be an entity, firm, or partnership.

Required Documents

- Identity proof documents: voter ID, Aadhaar card, identity card/ID

- Age proof document,

- Residential proof details

- Income proof documents include salary slips, salary certificates, income tax returns.

Features of Tata Motors Finance Limited Car Loan

- The loans are flexible with repayment of 12-60 months.

- The minimum loan amount is Rs. 125, 000

- The application process is simple and requires few documents

- Good repayment interest rates.

- No extra charges

- Transparent payment platforms.

Types of Tata Motors Finance Limited car loan

- Passenger vehicle loans

- Tata used vehicle loans

- Medium and heavy commercial vehicles

- Small and light commercial vehicle loan.

Tata Motors Finance Limited Car Loan Application Process

Step by step Tata Motors Finance Limited car application 2025 process

- Open the Tata Motor Finance Limited website portal link https://www.tmf.co.in/

- Proceed to the loan section and choose the category you wish to avail: passenger vehicle, used vehicle, medium and heavy commercial vehicle, or small and light commercial vehicle.

- Next, choose the “apply for loan” button to proceed.

- A new page will open showing three options:

- Loan for buying a vehicle

- Loan against existing vehicle

- Transfer existing loan.

- Review the options and select the “loan for buying a vehicle” > “new vehicle or used vehicle” option.

- The system will verify the details and direct you to the loan application process.

Download Tata Motors Finance Loan Statement 2025

Step by step to download Tata Motors Finance Limited online statement

- Visit the Tata Motors Finance website portal https://www.tmf.co.in.

- Select the “login” button followed by the “customer” option from the menu.

- Press the “login” tab to access the page.

- Choose mobile number as the login option and enter the registered mobile number.

- Recheck the number and click the “login” button.

- The system will send an OTP code to the number.

- Use the OTP and select the “continue” button.

- After login process select the “TMF loan account” > “home” tab.

- The page will show various options; select the “annual statement” option.

- Choose the “Tata motors contract number” and click the “submit” tab.

- Select the tab “download as PDF” to get the online statement on your device.

- The user will get the total amount paid, in the last financial year, account details, and principal amount paid.

Monthly Payment History for the TMF Loan

- Go to the Tata Motors Finance Motors website portal.

- Open page menu and select “home” tab > “Cardex” option to continue.

- Choose your loan account/contract number from the list and select submit button.

- The page will show the payment history (EMI history) on the screen.

Through the online statement, the user can avail the following details:

- Principal amount collected

- Overdue payments

- Charges

- Total amount paid

Tata Motors Finance Customer Care Number

1800-209-0188 ( Monday to Saturday 9AM to 7PM)

FAQs

- Does Tata Motor Finance allow borrowers to do a balance transfer?

Yes, a borrower can do a balance transfer to increase their repayment period and reduce the monthly EMI.

- Can a borrower get top-up loans from TMF?

The TMF offers top-up loans if the user has paid two EMIs.

- TMF Full Form?

Tata Motors Finance (TMF)